Business Finance Strategies 2025 for Entrepreneurs & SMES

Smart Business Finance Strategies in 2025: A Complete Guide for Entrepreneurs and SMEs

1. Understanding Business Finance: The Foundation of Every Business

The foundation of any successful endeavor is business finance. Whether you’re a startup founder, small business owner, or running a large enterprise, having a strong grip on financial management is critical. Business finance includes budgeting, expense control, revenue forecasting, and investment allocation. A clear understanding of your financial health helps in making informed decisions, managing cash flow, and avoiding debt traps.

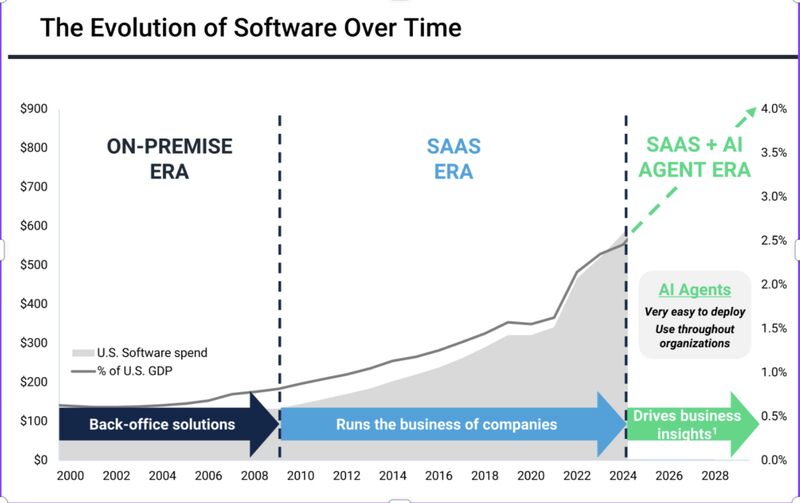

In 2025, business environments are changing rapidly due to automation, global supply chain disruptions, and AI-driven analytics. Entrepreneurs must adapt their financial strategies accordingly. Focus on maintaining a positive cash flow, reducing unnecessary liabilities, and continuously tracking business performance through digital finance tools.

2. Investment Planning for Entrepreneurs: Where to Put Your Money in 2025

In today’s competitive market, investment planning is no longer optional—it’s a necessity. Entrepreneurs must make smart, diversified investments to ensure their business grows and survives downturns. In 2025, promising options include digital real estate, AI-powered startups, fintech, sustainable energy, and e-commerce infrastructure. Before investing, always perform risk assessment and financial forecasting to know where you stand.

Having a financial advisor or using AI-based investment apps can help analyze trends, reduce human error, and maximize ROI. Focus on both short-term liquidity and long-term stability. Reinvesting profits smartly is also a part of sustainable business finance.

3. Managing Business Loans and Credit Effectively

Access to credit is crucial, but managing it efficiently is even more important. Business loans, when used wisely, can scale operations, boost marketing, or launch new products. However, poor credit management can cripple a business. Entrepreneurs should focus on choosing the right type of loan—term loans, working capital finance, or SME-specific credit schemes.

In 2025, many fin tech platforms offer low-interest loans for small businesses with minimal paperwork. Keeping your credit score healthy, repaying on time, and avoiding multiple loans at once is part of sound financial planning. Understand loan terms, hidden charges, and use tools like EMI calculators to stay on top.

4. Budgeting and Expense Tracking in the Digital Age

Budgeting has become more dynamic than ever. Gone are the days of using Excel sheets for tracking expenses. Now, cloud-based accounting platforms like QuickBooks, Zoho Books, and Xero help business owners automate budgeting and reduce financial stress. Setting monthly, quarterly, and annual budgets allows a business to grow with control.

Use KPIs (Key Performance Indicators) to evaluate performance. Regularly analyze where your business spends most—marketing, production, or HR—and adjust accordingly. Expense tracking not only controls costs but reveals areas of unnecessary waste. In the long run, a lean approach to budgeting brings higher profits and better survival rates.

5. Building a Sustainable Financial Plan for SMEs

Small and Medium Enterprises (SMEs) often face unstable income, sudden expenses, and limited access to capital. That’s why building a sustainable financial plan is essential. A good plan considers inflation, taxes, insurance, and future expansion. It should also include emergency reserves, employee payroll forecasts, and equipment upgrades.

Start by conducting a SWOT analysis of your business finances. Set realistic financial goals and break them into actionable monthly tasks. Collaborate with financial consultants if needed, and revisit your plan every quarter. In 2025, many governments are offering SME grants—take advantage of them.

6. Using Technology to Improve Business Finance

Technology plays a vital role in modern financial management. From AI-driven financial reporting to block chain-based secure transactions, businesses now have tools that were unavailable a decade ago. By integrating ERP (Enterprise Resource Planning) systems and digital payment gateways, businesses streamline both incoming and outgoing cash.

Use data analytics to predict seasonal trends, customer behavior, and sales projections. AI chat bots are helping many finance teams answer queries instantly, saving time and effort. The rise of decentralized finance (DeFi) and virtual finance departments is revolutionizing how entrepreneurs handle money.

Conclusion: Business Finance in 2025 Demands Smart Moves

Business finance in 2025 is not just about managing money—it’s about mastering strategic thinking, using the latest technology, and staying future-ready. Entrepreneurs who understand finance, adapt to market trends, and embrace innovation will thrive. Don’t just aim to survive—plan to grow.

zge2cy

2q633b

jkewe9

mwtdka

pao22t

zsfs77

Продажа тяговых АКБ https://faamru.com для складской техники любого типа: вилочные погрузчики, ричтраки, электрические тележки и штабелеры. Качественные аккумуляторные батареи, долгий срок службы, гарантия и профессиональный подбор.

кіно онлайн 2025 мультфільми для дітей безкоштовно

There are some interesting points in time on this article but I don’t know if I see all of them middle to heart. There’s some validity however I will take hold opinion until I look into it further. Good article , thanks and we would like extra! Added to FeedBurner as nicely

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers

заклепка вытяжная 3 2х8 заклепка вытяжная нерж

Вместо заблокированного используйте kraken darknet market альтернативное зеркало из списка

дизайн спальни в доме дизайн коттеджа